Table Of Content

If the current rate is significantly lower than the original, the homeowner might consider shortening the new loan’s maturity. In today’s hot market, sellers often accept cash transactions ensuring that the deal will close, which can be a risky choice for the buyer. The danger to the buyer is that they may be overpaying for the home.

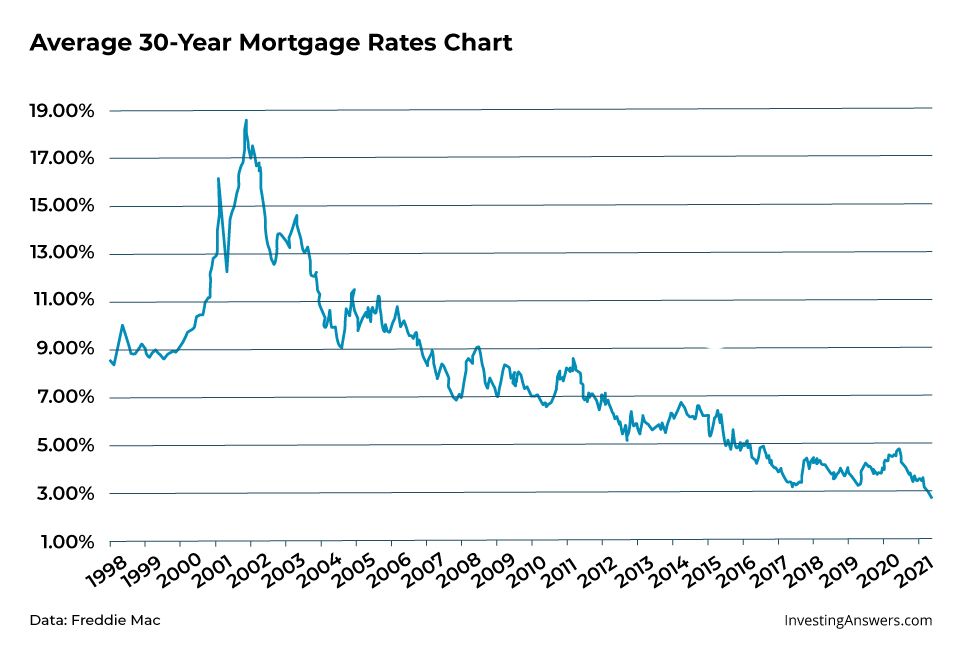

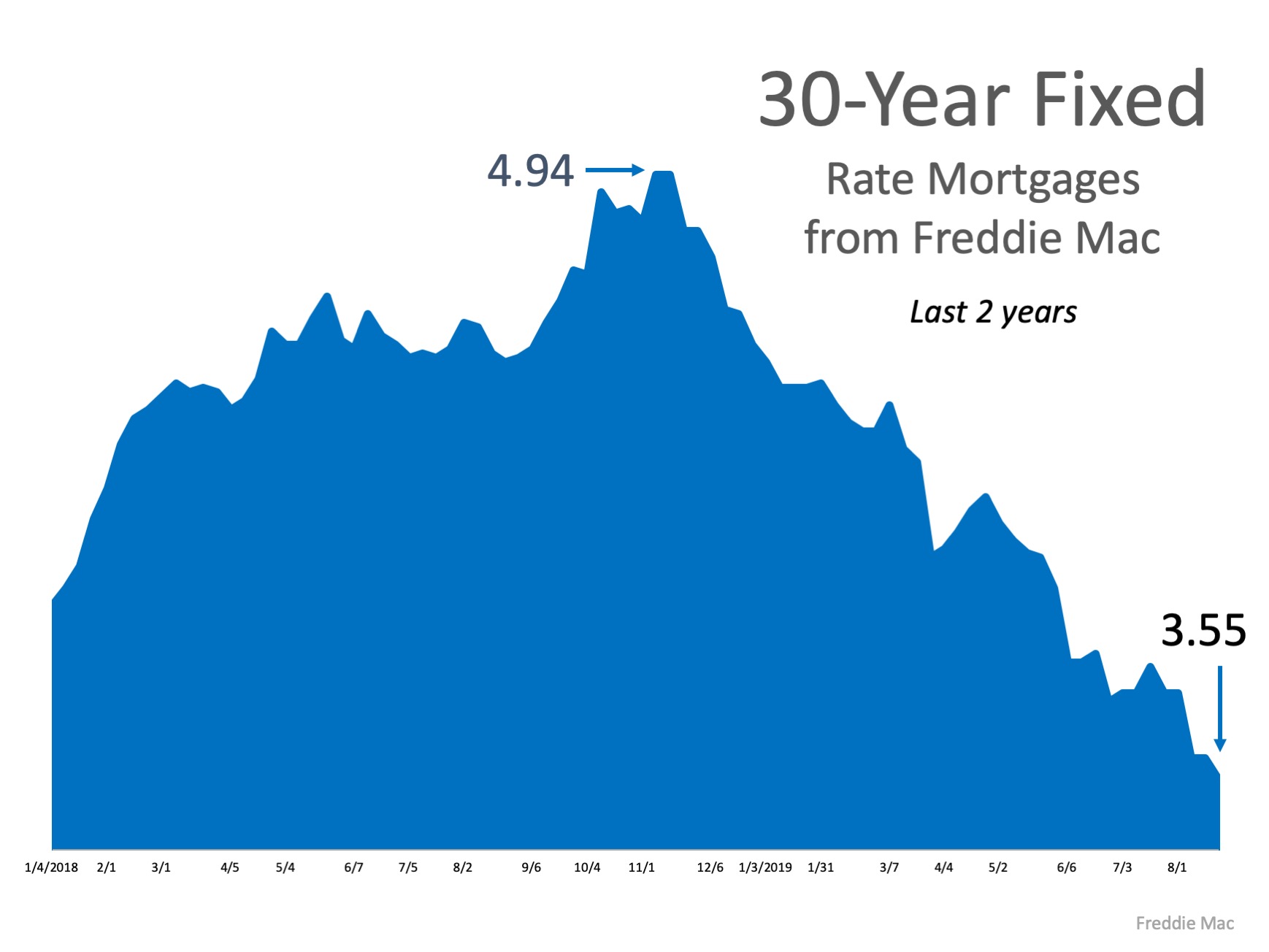

Mortgage Interest Rates Forecast

The cost can vary depending on many factors, including your lender and how much you’re borrowing. It’s possible to get the seller or lender to pay a portion or all of these costs. A teaser rate is a lower initial rate offered on a mortgage loan for a set time period before the actual fixed mortgage rate goes into effect. Teaser rates are often obtained through an adjustable-rate mortgage (ARM) loan, that have 3-, 5- or 7-year options. Be sure to shop for those quotes on the same day, since mortgage interest rates change on a daily basis.

What is a lender credit?

Most rate locks last 30 to 60 days and your lender may not charge a fee for this initial period. However, extending the rate lock period up to 90 or 120 days is possible, depending on your lender, but additional costs may apply. If you come from a qualifying military background, VA loans can be your best option.

How Much Does It Cost To Refinance A Mortgage?

The average 30-year fixed mortgage rate was 7.17% this week, according to Freddie Mac. This is a seven-basis-point increase from the previous week. The monthly payment shown is made up of principal and interest. It does not include amounts for taxes and insurance premiums. The monthly payment obligation will be greater if taxes and insurance are included.

Mortgage Rates Stay High Amid Inflation Fears - Bankrate.com

Mortgage Rates Stay High Amid Inflation Fears.

Posted: Wed, 24 Apr 2024 20:03:45 GMT [source]

There are also no credit score minimums for USDA or VA refinances; however, lenders might apply their own standards to these refinances. The average APR on the 30-year fixed-rate jumbo mortgage refinance is 7.72%. This week, average 15-year mortgage rates were 6.44%, a five-basis-point increase from the previous week, according to Freddie Mac data.

Refinance calculator

The interest rate is the amount your lender charges you for using their money. ARM loan rates are based on an index and margin and may adjust as outlined in your agreement. So it’s a good idea to check assumptions when you’re comparing rates. To see ours, select the View Legal Disclosures link under where rates are displayed. Your rate will be different depending on your credit score and other details.

Compare Today’s Home Loan Refinance Rates

Our site has comprehensive free listings and information for a variety of financial services from mortgages to banking to insurance, but we don’t include every product in the marketplace. In addition, though we strive to make our listings as current as possible, check with the individual providers for the latest information. When interest rates rise, reflecting changes in the economy and financial markets, so too do mortgage rates—and vice versa.

Find the best mortgage rates for your home loan

A 15-year, fixed-rate mortgage with today’s interest rate of 6.90% will cost $893 per month in principal and interest on a $100,000 mortgage (not including taxes and insurance). In this scenario, borrowers would pay approximately $60,734 in total interest. Keep in mind, the 30-year mortgage may have a higher interest rate than the 15-year mortgage, meaning you'll pay more interest over time since you're likely making payments over a longer period of time. Additionally, spreading the principal payments over 30 years means you'll build equity at a slower pace than with a shorter term loan.

If you don't close on the loan before the rate lock expires, you might get stuck with a higher interest rate. The lender will gather these details when you apply for a mortgage preapproval and will provide an estimate of a personalized rate. For buyers with limited credit or finances, a government-backed loan is usually the better option as the minimum loan requirements are easier to satisfy. The Federal Reserve has shown signs that it’s unlikely to raise rates again soon, and investors and market watchers are waiting expectantly for the first cut of 2024. However, a cut likely won’t materialize until summer, at the earliest. Mortgage rates rose throughout 2023 but are expected to drop in 2024.

Today’s 15-year mortgage (fixed-rate) is 6.90%, up 0.18 percentage point from the previous week. The same time last week, the 15-year, fixed-rate mortgage was at 6.72%. For borrowers who want to pay off their home faster, the average rate on a 15-year fixed mortgage is 6.90%, up 0.18 percentage point from the previous week. Rene Bermudez is a staff writer at LendingTree, where she covers mortgages and personal finance. She researches both current and historical trends in the mortgage industry in order to give the best analysis and guidance to readers grappling with these complex financial products. If you’re interested in taking out a mortgage, Channel’s advice is to focus on what you can afford in the current market.

Our mortgage refinance calculator helps estimate your new monthly payment and the difference in total interest costs. Mortgage rates aren't directly impacted by changes to the federal funds rate, but they often trend up or down ahead of Fed policy moves. This is because mortgage rates change based on investor demand for mortgage-backed securities, and this demand is often impacted by how investors expect Fed hikes to affect the broader economy. The rates shown above are the current rates for the purchase of a single-family primary residence based on a 45-day lock period.

First, you don’t need to make a down payment in most situations. Second, borrowers pay a one-time funding fee but don’t pay an annual fee as the FHA and USDA loan programs require. Buyers in eligible rural areas with a moderate income or lower may also consider USDA loans.

The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms to find the product that’s right for you. Be careful not to confuse interest rates and APR — both are expressed as a percentage, but they’re very different. A typical interest rate accounts only for the fees you’re paying a lender for borrowing money. An APR, on the other hand, captures a broader view of the costs you’ll pay to take out a loan, including the interest rate plus closing costs and fees.

Importantly, when comparing offers, homebuyers need to take into account other costs beyond principal and interest payments. With an adjustable rate, the rate is steady for a set number of years (often five or seven), and then can change every adjustment period (often once per year). If that rate goes up or down, so does the interest rate on your loan.

No comments:

Post a Comment